Review of POLLACKONOMICS, a PLANET TRACKER investigation

The review of the investigation was prepared by experts in the fields of economics and ecology on the request of FSA.

The international organization PLANET TRACKER, in July 2021, published an investigation “Pollockonomics: What a single trawler purchase reveals about the economics of the world’s largest source of palatable fish.”

PLANET TRACKER (РТ) is a non-profit financial think tank. It was created primarily for the investor community to analyse the risk of market failure related to environmental limits which, other than climate change, should be taken into account by investors. PT generates analytics to redefine how financial and environmental data interact with the aim of changing the practices of financial decision makers to help avoid both environmental and financial failure.

SEAFOOD TRACKER (ST) is a part of the Planet Tracker Group. ST investigates the impact that financial institutions can have on sustainable corporate practices through their funding of publicly listed wild-catch and aquaculture to align capital markets with the sustainable management of ocean and coastal marine resources.

In this report is analysed the long-term profitability in the walleye pollock fishery, as one of the largest in the world, and discussed the natural capital and geopolitical implications of Russia’s ambitious seafood investments.

The original article is available free of charge (registration is required).

Link to the convenience translation of the article.

Reviews:

I.N. Rykova, Head of the Center of Industrial Economics of the Financial Research Institute (FRI) of the Ministry of Finance of the Russian Federation, Doctor of Economics, Academician of the Russian Academy of Natural Sciences

The main conclusion of the study is that the future of the walleye pollock fishery in Russia and the USA, the main countries for this species harvesting, is in the renewal of the fishing fleet. It is necessary to expand the sources of investment to accomplish this objective.

The investigation provides a detailed analysis of the case of the purchase of a foreign 1992-built fishing vessel for the Russian pollock fishery. Despite the age of the trawler, its "high maintenance costs" and "high safety risks", the economic sense of the deal consummated is explained by the payback of this vessel in 5 years, after which it will begin to return a profit. However, all these calculations do not take into account the safety risks of fishing and navigation on such an old vessel. The authors of the investigation cite the results of a survey of 60 captains of large-tonnage Russian fishing vessels conducted by VCIOM in 2015: in 2015, 36% of Russian captains rated the state of their vessels as "bad" or "very bad", with 78% of them saying that most fishing vessels are obsolete and need to be replaced.

According to the authors, strong demand for walleye pollock products in the world market has been driving ambitious investments in the vessel capacity in Russia. In the USA, the aged pollock fishing fleet needs to be modernized, which will requires large financial investments. Purchases of second-hand vessels are likely to be less frequent in the future: in Russia and in the United States, the legislative framework seems to force fishing companies to buy only domestic-built vessels or pay a high price to legalize vessels built in other countries. This is a good thing, since new vessels are more cost-effective and friendly than old ones of similar size (more efficient engines, zero-waste processing resulting in reduced fish discards, etc.).

Zgurovsky Konstantin Aleksandrovich, Senior Advisor to the Sustainable Marine Fisheries Program (WWF-Russia), Cand. Sc. Biology, Honorary Ecologist of the Russian Federation

The POLLACKONOMICS report makes a nice impression. It is important that the authors bring up the subject of marine ecology and sustainable walleye pollock fishery. Those who modernize the fishing fleet obtain an advantage in the market and development potential. The authors emphasize that American pollock harvesters will also follow this route. The investigation notes the acceptance of certification of pollock fishery sustainability by the international market and the growing importance of the compliance of vessels, methods of fishing and resource conservation with these certification standards. It is obvious that such standards will be more stringent in the future. The study’s economic calculations are also interesting, in particular, a comparison between new vessels as an investment in the future and the purchase of an old powerful fishing vessel is as a dilemma: "safety" or "immediate profit".

According to the authors, despite the profitability and sustainability of the walleye pollock fishery, it is under threat due to significant investments in the construction of a new fishing fleet and climate change, which can result in serious consequences for global food security and geopolitical tensions. Both the so-called "fleet overcapacity" and the climate impact on aquatic biological resources (and vice versa, the impact of fishing vessels emissions of CO2 and sulfur) have taken on greater and greater importance in recent years.

Indeed, on the one hand, the construction of a new more advanced and efficient fleet increases the level of use of ABR, i.e. much more profit can be made from catch per one and the same unit effort that makes the fishery more efficient and sustainable. On the other hand, with the absence of a consistent program for retiring old vessels, the pressure on biological resources is growing, so-called overfishing happens, which can result in the collapse of massive fishery, which the walleye pollock fishery is.

One of the unsolved challenges of walleye pollock fishery is discarding juveniles over board. WWF-Russia, in response to a report published in February 2021 on the process of assessing the extension MSC coverage of fishery in the Sea of Okhotsk (the largest in Russia) commented, “Information on the discard of juvenile pollock, roe-stripping and juvenile mortality is controversial and in some cases incomplete. The effective regulation of the Russian pollock fishery is impaired by inadequate observer programs, assessment of total catch using catch conversion rates applied to final products volumes, and the absence of information on harvest capacity relative to stock size.” WWF initially opposed the certification of the fishery in the Sea of Okhotsk, but withdrew its protest after it reached an agreement with Pollock Catchers Association.

The authors point out that one of the challenges of walleye pollock fishing in the US zone is the old age of the fleet (40 years for pollock factory trawlers in 2016, 12 years more than in Russia), it means that US fishing fleet will have to be renewed sooner rather than later.

Executive Summary of the Pollackonomics Investigation

-

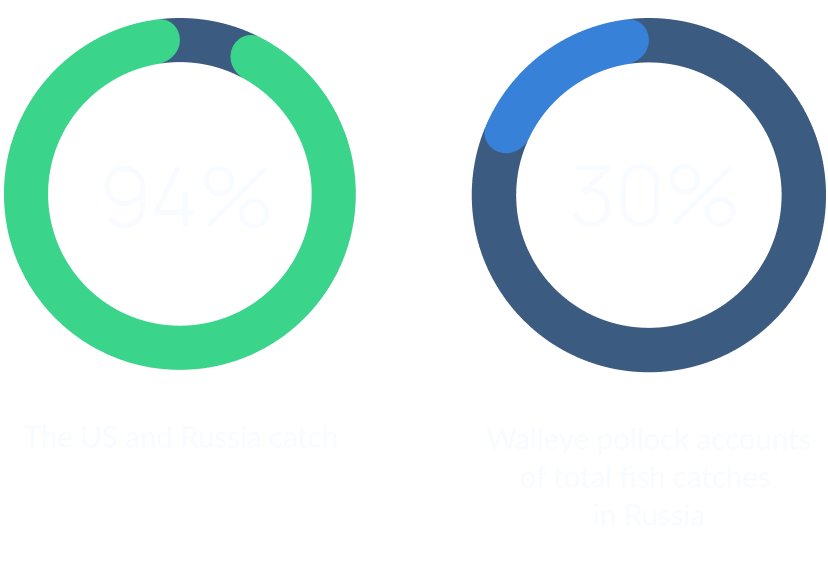

The US and Russia catch 94% of the world’s pollock. Walleye pollock is the world's second largest commercial species in terms of total catches. Walleye pollock accounts for around 30% of total fish catches in Russia.

Walleye pollock is the most important seafood import for the EU and the majority of it comes processed from China. Overall, 53 companies in two countries harvest pollock certified according to the voluntary MSC Sustainable Fisheries standard. 10 companies control half of the global walleye pollock harvesting, and that number is set to decrease given ongoing consolidation among fishing companies (American Seafoods, Nissui, Trident Seafoods, Maruha Nichiro, and Cooke for US-caught pollock; Russian Fishery Company, Gidostroy, Okeanrybflot, NBAMR and NOREBO for Russian pollock).

-

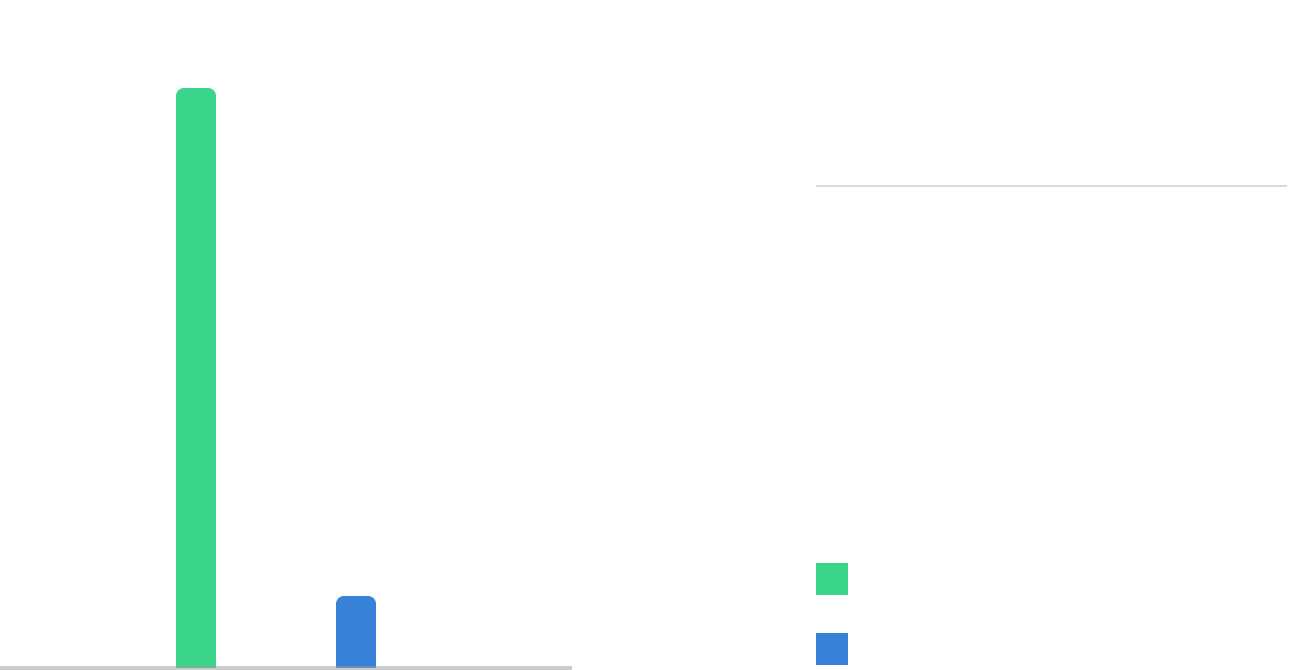

Marine factory trawling (fishery with using processing-trawlers) is extremely profitable, especially fishing for walleye pollock, which is relative the mass fish. The average EBIT margin of all fishing companies engaged in trawling worldwide (whether private or public) that at least partly report their financials is 27%.

Achieving an operating margin of 30% is rare in most industries: in a sector comparison of margins across 94 industries in the US, only three (38 firms out of 7,582) had average operating margins of 30% or above: tobacco, railroad transportation and water utilities.

In Russia, industrial fishing accounts for 83% of pollock quotas, with another 13% allocated to coastal fishing. In 2016, five companies (RFC, Okeanrybflot, Gidrostroy, Norebo and NBAMR) owned 50% of the quotas for pollock in Russia.

The high level of profitability in the walleye pollock trawling industry is main evidence that the sustainable management of fish populations can ensure high financial performance: effective management both in Russia and the US notably through reasonable quotas have taken that species out of the overfishing zone. In contrast, where the walleye pollock stock was not managed properly (in the Central Bering Sea), it was almost wiped out by overfishing.

-

Harvesters of pollock sell it at 1 euro per kilogram when simply headed and gutted, and 3 euros when filleted. Western European retailers sell pollock at around 5 euros per kilogram as a fillet or fish finger.

In Western European and American markets, walleye pollock can be sold as a sustainable fish, since all of American and most of Russian catches of walleye pollock are certified by the Marine Stewardship Council (MSC).

The supply of walleye pollock products to the EU reached its highest level ever in 2019, at 305,007 tonnes, equivalent to EUR 838 million (USD 939 million).

The proportion of certified pollock is likely to rise since several pollock fisheries in Russia have entered Fisheries Improvement Programmes (FIP), with a view to securing MSC certification. Strong retail-led demand for pollock drives investments in value chains (processing).

-

The implementation of the investment quota program, in Russia, has resulted in increased processing capacity for multiple species, including walleye pollock. For instance, in the first four months of 2021, five processing plants have come on stream in Russia, bringing an additional 7,000 tons of fillets to markets in the period.

Overall, this initiative is very likely to lead to an increase in investments ongoing by large companies in the Russian Far East, in particular, in walleye pollock harvesting.

One example of the investments ongoing in the pollock fishing fleet in the Russian Far East Basin, RFC launched an investment of about USD 900 million for the construction of ten pollock supertrawlers in St Petersburg.

Each vessel is designed to catch about 60,000 tons of fish, around twice as much as existing vessels. As of June 2021, there were 56 new fishing vessels and 35 new crab vessels under construction, each being built by companies under the investment quota program.

-

In February 2021, all seafood exports from Russia to China almost ceased. Pollock caught in Russia is typically sent to China to be processed. Chinese pollock imports are worth c. USD 600 million to Russia and China accounts for more than 60% of Russian pollock exports.

-

Pollock value chain in foreign markets:

- After it is caught, walleye pollock is typically processed and in most cases processed at least twice before it reaches the end consumer.

- Primary processing happens either onshore or on a trawler.

- The resulting product (headed and gutted fish, fillet, surimi or roe) is then shipped to a secondary processor (typically based in China for fillets or in Japan for surimi and roe).

- The product is then processed a first time by at least 300 companies, typically in China, the US or Western Europe.

- Often, pollock is processed a second time, typically in Japan, China, Western Europe or the US before ending up on the plate of consumers.

- Other stages of the supply chain involve storage, packing and repacking, distribution and wholesale.

Any disruption to the supply of walleye pollock would have significant impact down the value chain.

Key factors of the development of pollock fishing and processing in the coming years:

- A lower biomass of walleye pollock stock will result in a reduction in pollock quotas in the next several years.

- Walleye pollock is no longer overfished either on the Russian or the US side.

- Being MSC certified is an important driver of foreign demand: all certified fisheries in Russia are export-oriented and having an MSC certificate is not merely a competitive advantage, but a must in foreign markets. In addition, certified seafood products from Russia are able to generate a significant price premium when sold abroad compared to non-certified products: as much as 30–40% for pollock filets, given that retailers Aldi, Lidl and Kaufland only purchase MSC certified pollock.

- The effective regulation of the Russian pollock fishery is impaired by inadequate observer programs, assessment of total catch using product recovery rates applied to final products volumes, and the absence of information on harvest capacity relative to stock size.

What pollock harvesters and processors should do

- Retire, write off and sell for scrap old factory trawlers, which are typically less environmental friendly and less compliant with and sustainable fisheries standards than recent ones (e.g. higher bycatch rates, higher fuel consumption, etc.).

- Use sustainability-linked loans or other forms of financing attached to natural capital covenants to finance the fishing fleet renewal.

- Refrain from bidding for quotas in the Arctic due to the lack of complete data on the sustainability of fish stocks in Arctic waters.

- Implement robust traceability systems (for those who have not yet done so) and ensure that these are compatible with those used across the supply chain. This is especially the case for secondary processors that use Russian-caught pollock, where IUU fishing risk is significant.

- Publish actual tonnage of fish harvested by species.

- Submit adaptation plans to [for] changes in the distribution of pollock populations caused by climate change (especially for [US-based companies] companies based in the USA). Outline plans to adapt to the climate change-induced change in the distribution of pollock populations (especially for US-based companies).

What investors should do

In the US, substantial fishing vessels modernization is needed. This is likely to translate into a need for a fresh capital injection and provides investors with a once in a generation opportunity to further improve the sustainability of the pollock industry by demanding for instance lower bycatch volumes, reduced GHG emissions and reduced IUU risk.

Many of the issues described in this report about walleye pollock are applicable to other seafood supply chains (e.g. sustainability of fishery vs profitability, traceability and combating IUU fishing, fleet capacity and returns, the rising demand for certified fish and thus the importance of MSC certification, climate change impact, food security and geopolitical tensions, etc.).

Click here to read the convenience translation of the article.